What Is The Child Tax Credit For 2020 . You can get child tax credit if you are 16 or over. Financial help if you have children. There are some exceptions to this rule, for example if you’re expecting twins or. the child tax credit helps families with qualifying children get a tax break. Child tax credits if you're responsible for. These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. manage an existing benefit, payment or claim. If you are under 16 your parents, or someone who is responsible. updated 29 february 2024. You may be able to claim the credit. you could get £3,455 a year for each child. you can usually get child tax credits for each child or young person you’re responsible for until the 31 august after. child tax credit will be paid directly into your bank, building society or through the payment exception service if you are.

from fabalabse.com

the child tax credit helps families with qualifying children get a tax break. Child tax credits if you're responsible for. Financial help if you have children. You may be able to claim the credit. child tax credit will be paid directly into your bank, building society or through the payment exception service if you are. manage an existing benefit, payment or claim. There are some exceptions to this rule, for example if you’re expecting twins or. You can get child tax credit if you are 16 or over. you can usually get child tax credits for each child or young person you’re responsible for until the 31 august after. These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by.

What is the difference between Child Tax Credit and child care tax

What Is The Child Tax Credit For 2020 updated 29 february 2024. If you are under 16 your parents, or someone who is responsible. You can get child tax credit if you are 16 or over. manage an existing benefit, payment or claim. These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. Financial help if you have children. you could get £3,455 a year for each child. the child tax credit helps families with qualifying children get a tax break. you can usually get child tax credits for each child or young person you’re responsible for until the 31 august after. Child tax credits if you're responsible for. updated 29 february 2024. child tax credit will be paid directly into your bank, building society or through the payment exception service if you are. You may be able to claim the credit. There are some exceptions to this rule, for example if you’re expecting twins or.

From policyinpractice.co.uk

Two child limit to tax credits set to drive child poverty up by 10 by What Is The Child Tax Credit For 2020 manage an existing benefit, payment or claim. These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. Child tax credits if you're responsible for. Financial help if you have children. You can get child tax credit if you are 16 or over. You may be able to claim the credit. If you are under. What Is The Child Tax Credit For 2020.

From www.taxpolicycenter.org

What is the child tax credit (CTC)? Tax Policy Center What Is The Child Tax Credit For 2020 These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. manage an existing benefit, payment or claim. You can get child tax credit if you are 16 or over. You may be able to claim the credit. If you are under 16 your parents, or someone who is responsible. the child tax credit. What Is The Child Tax Credit For 2020.

From www.expatustax.com

What is Child Tax Credit (CTC)? Expat US Tax What Is The Child Tax Credit For 2020 These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. you could get £3,455 a year for each child. If you are under 16 your parents, or someone who is responsible. You can get child tax credit if you are 16 or over. manage an existing benefit, payment or claim. the child. What Is The Child Tax Credit For 2020.

From theaccountingandtax.com

Child tax credit Who is eligible? The Accounting and Tax What Is The Child Tax Credit For 2020 These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. If you are under 16 your parents, or someone who is responsible. you could get £3,455 a year for each child. You may be able to claim the credit. you can usually get child tax credits for each child or young person you’re. What Is The Child Tax Credit For 2020.

From www.earlychildhoodalliance.net

2020 Tax Filing Will Determine ChildTax Credit Periodic Payments in What Is The Child Tax Credit For 2020 You can get child tax credit if you are 16 or over. Child tax credits if you're responsible for. you could get £3,455 a year for each child. There are some exceptions to this rule, for example if you’re expecting twins or. manage an existing benefit, payment or claim. You may be able to claim the credit. . What Is The Child Tax Credit For 2020.

From www.khou.com

Child tax credit limit and age info — view requirements What Is The Child Tax Credit For 2020 You may be able to claim the credit. These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. updated 29 february 2024. You can get child tax credit if you are 16 or over. Child tax credits if you're responsible for. There are some exceptions to this rule, for example if you’re expecting twins. What Is The Child Tax Credit For 2020.

From www.youtube.com

Is the child tax credit for 2020 or 2021? YouTube What Is The Child Tax Credit For 2020 You can get child tax credit if you are 16 or over. You may be able to claim the credit. child tax credit will be paid directly into your bank, building society or through the payment exception service if you are. There are some exceptions to this rule, for example if you’re expecting twins or. you can usually. What Is The Child Tax Credit For 2020.

From d334jacquelineprice.blogspot.com

D Jacqueline Price Child Tax Credit Eligibility 2020 What Is The Child Tax Credit For 2020 You may be able to claim the credit. manage an existing benefit, payment or claim. Child tax credits if you're responsible for. If you are under 16 your parents, or someone who is responsible. you can usually get child tax credits for each child or young person you’re responsible for until the 31 august after. There are some. What Is The Child Tax Credit For 2020.

From goqbo.com

Advancements in the Child Tax Credits Quality Back Office What Is The Child Tax Credit For 2020 Child tax credits if you're responsible for. manage an existing benefit, payment or claim. These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. the child tax credit helps families with qualifying children get a tax break. child tax credit will be paid directly into your bank, building society or through the. What Is The Child Tax Credit For 2020.

From www.busconomico.us

What is the Child Tax Credit and who qualifies? What Is The Child Tax Credit For 2020 If you are under 16 your parents, or someone who is responsible. Child tax credits if you're responsible for. the child tax credit helps families with qualifying children get a tax break. manage an existing benefit, payment or claim. You can get child tax credit if you are 16 or over. Financial help if you have children. You. What Is The Child Tax Credit For 2020.

From learningschoolzazobezx.z22.web.core.windows.net

Child Tax Credit Worksheet 2020 Pdf What Is The Child Tax Credit For 2020 These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. you can usually get child tax credits for each child or young person you’re responsible for until the 31 august after. Child tax credits if you're responsible for. manage an existing benefit, payment or claim. You can get child tax credit if you. What Is The Child Tax Credit For 2020.

From fabalabse.com

Who gets the monthly tax credit? Leia aqui Who qualifies for the new What Is The Child Tax Credit For 2020 There are some exceptions to this rule, for example if you’re expecting twins or. Child tax credits if you're responsible for. Financial help if you have children. You may be able to claim the credit. manage an existing benefit, payment or claim. updated 29 february 2024. These tables show rates and allowances for tax credits, child benefit and. What Is The Child Tax Credit For 2020.

From fabalabse.com

How do you qualify for the Child Tax Credit in 2020? Leia aqui Why am What Is The Child Tax Credit For 2020 Child tax credits if you're responsible for. you could get £3,455 a year for each child. You can get child tax credit if you are 16 or over. You may be able to claim the credit. There are some exceptions to this rule, for example if you’re expecting twins or. the child tax credit helps families with qualifying. What Is The Child Tax Credit For 2020.

From www.cbpp.org

YearEnd Tax Policy Priority Expand the Child Tax Credit for the 19 What Is The Child Tax Credit For 2020 If you are under 16 your parents, or someone who is responsible. manage an existing benefit, payment or claim. Financial help if you have children. updated 29 february 2024. There are some exceptions to this rule, for example if you’re expecting twins or. you can usually get child tax credits for each child or young person you’re. What Is The Child Tax Credit For 2020.

From what-benefits.com

What Is Child Tax Benefit What Is The Child Tax Credit For 2020 If you are under 16 your parents, or someone who is responsible. updated 29 february 2024. the child tax credit helps families with qualifying children get a tax break. child tax credit will be paid directly into your bank, building society or through the payment exception service if you are. you could get £3,455 a year. What Is The Child Tax Credit For 2020.

From fabalabse.com

How much was the Child Tax Credit for 2020? Leia aqui Is there a What Is The Child Tax Credit For 2020 These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. You may be able to claim the credit. If you are under 16 your parents, or someone who is responsible. There are some exceptions to this rule, for example if you’re expecting twins or. Child tax credits if you're responsible for. child tax credit. What Is The Child Tax Credit For 2020.

From bezyah.weebly.com

Child tax credit 2020 changes bezyah What Is The Child Tax Credit For 2020 child tax credit will be paid directly into your bank, building society or through the payment exception service if you are. Financial help if you have children. updated 29 february 2024. These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. If you are under 16 your parents, or someone who is responsible.. What Is The Child Tax Credit For 2020.

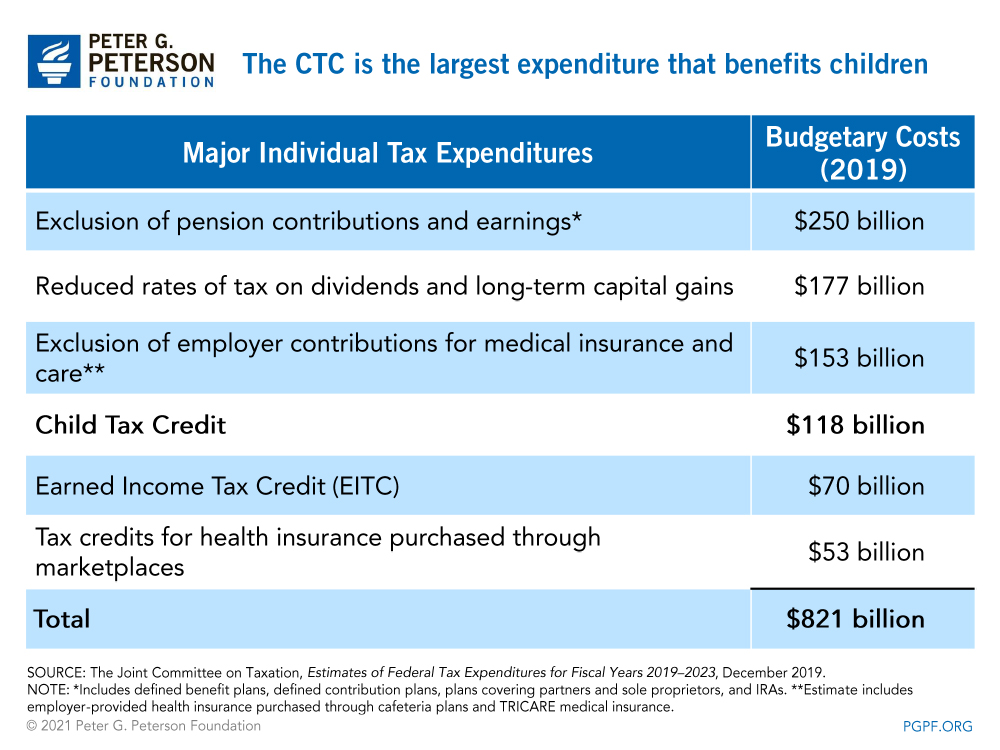

From www.pgpf.org

What Is the Child Tax Credit? What Is The Child Tax Credit For 2020 These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by. You can get child tax credit if you are 16 or over. you could get £3,455 a year for each child. Financial help if you have children. Child tax credits if you're responsible for. the child tax credit helps families with qualifying children. What Is The Child Tax Credit For 2020.